In a recent speech made at an investment conference today, Reserve Bank Governor Mr Glenn Steven’s made the following comments about the Australian dollar (AUD) against the United States Dollar (USD). Note emphasis added

In a recent speech made at an investment conference today, Reserve Bank Governor Mr Glenn Steven’s made the following comments about the Australian dollar (AUD) against the United States Dollar (USD). Note emphasis added

“The foreign exchange market is perhaps another area in which investors should take care. While the direction of the exchange rate’s response to some recent events might be understandable, that was from levels that were already unusually high. These levels of the exchange rate are not supported by Australia’s relative levels of costs and productivity. Moreover, the terms of trade are likely to fall, not rise, from here. So it seems quite likely that at some point in the future the Australian dollar will be materially lower than it is today.“

Read speech in full: http://www.rba.gov.au/speeches/2013/sp-gov-291013.html

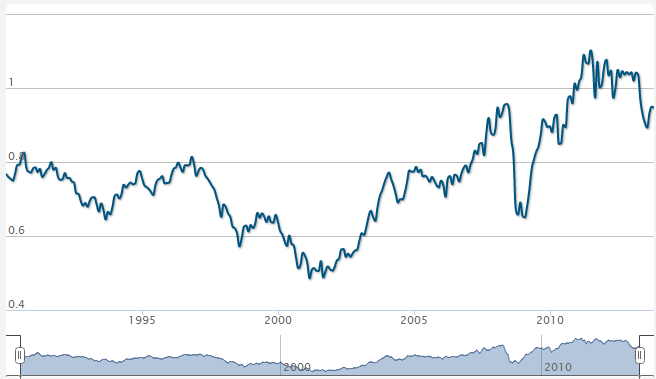

Readers may be interested to know that the average AUD:USD exchange rate over the past ten years is 86.71 cents, with a range of 68 cents to $1.10.

Should the Aussie dollar indeed fall to average rate, or lower, then the following benefits would flow through to investors (note the opposite will occur if the AUD appreciates against the USD):

1. Increase in unit price

A fall in the AUD:USD exchange rate will result in a higher unit price, up until the asset is sold and the profit distributed.

As the majority of the Fund’s assets are held in USD assets, a falling Aussie dollar increases the value of those assets (when converted from USD back to AUD).

For example, for illustrative purposes, imagine USD $10m of property was acquired when the AUD:USD was at parity (AUD1=USD1). Subsequently, the AUD:USD exchange rate falls to AUD1=USD0.86.

That same USD$10m of property now becomes comparatively worth AUD$11,627,906, and an unrealised profit of $1.6m is made. Up until the asset is sold, this unrealised gain is reflected in a higher unit price. After sale the profit is returned to investors via the bi-annual distribution.

2. Increase in rental yield

Aside from the increase in the unit price, investors also benefit from a falling Aussie dollar by receiving higher income returns.

This is because the rental income received is in USD (as the property is owned in the US) and so once converted back to Aussie dollars, there are more dollars available for distribution.

Consider a property that cost US$500,000 provides net rental income of USD$50,000 (i.e. a 10% return). At parity the income and return would be the same, but should the Aussie dollar fall to USD0.86 then the Aussie dollar equivalent of the USD$50,000 collected rises to $58,139, and the return increases to 11.6%.

Conclusion

Only time will tell if Mr Stevens is correct. If he is and the Aussie dollar does fall materially in value against the USD, then investors in the Passive Income (USA Commercial Property) Fund will be placed to profit.